October 14 – November 1

New Benefit Enhancements

We’re excited to announce that this year’s open enrollment includes even more enhancements to our already industry-leading benefits! Beginning January 1, 2025, you’ll have more income protection through the benefits below available to all Team Members at no cost:

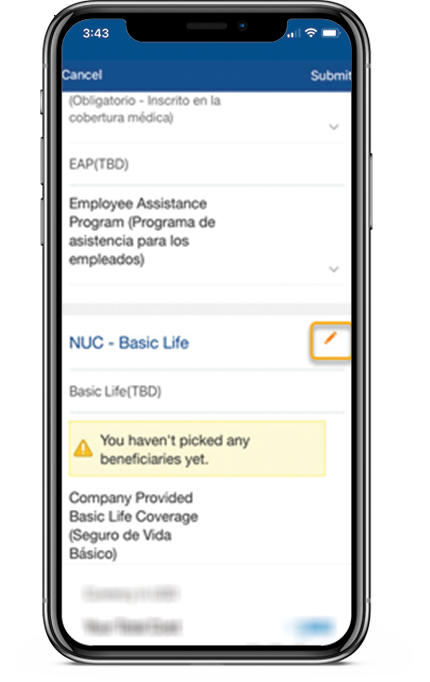

- Mortenson paid Life Insurance – 2x your annualized base rate of pay (3x annualized base pay for Team Members with greater than 10 years of service)

- Mortenson paid Accidental Death & Dismemberment (AD&D) Insurance – amount matches your life insurance amount and provides a benefit to you or your family in the case of an injury or death

- Mortenson paid Business Travel Accident Insurance – amount matches your life insurance amount and pays if something happens to you while traveling on business

Team Members with over 6 months of service will also be able to access the following benefits:

- Paid Military Leave – up to 2 weeks of paid military leave

- Paid Jury Duty – continue to get paid while fulfilling your civic responsibility or jury duty

- Adoption Assistance – $5,000 to reimburse you for the adoption of a new child to your family

- Tuition Reimbursement – same benefit (up to $5k per year in reimbursement) but now with only a 6-month eligibility waiting period

- Craft Dependent Scholarship Program – same great benefit, with a shorter 6-month waiting period and grandchildren of Team Members are now eligible for the benefit

Don’t miss out on these great new options during open enrollment from October 14-November 1 with benefits going live on January 1, 2025!

What is staying the same in 2025

Mortenson team members and their families will still have access to the dedicated CareConnect team

- You’ll be able to connect with a team of experts dedicated exclusively to Mortenson team members for answers to questions about the health needs of you and your family.

- Contact the CareConnect team at 1-833-209-6462

No changes for 2025 Rates! Review the 2025 medical and dental rates below. All rates were held flat in 2025 with the exception of Team Member Only and Family dental rates that decreased for 2025!

2025 Medical, Pharmacy, Vision, and Disability Weekly Rates

| Coverage Level | Medical, Pharmacy and Vision and Weekly Rates |

|---|---|

| Team Member | $26.74 |

| Team Member + Spouse | $68.53 |

| Team Member Plus Child(ren) | $61.41 |

| Family (Team Member Plus Spouse Plus Child(ren)) | $99.40 |

| Single Plus Domestic Partner1 | $68.53 |

| Single with Child(ren) Plus Domestic Partner 1 | $99.40 |

| Single Plus Domestic Partner with Child(ren) 1 | $99.40 |

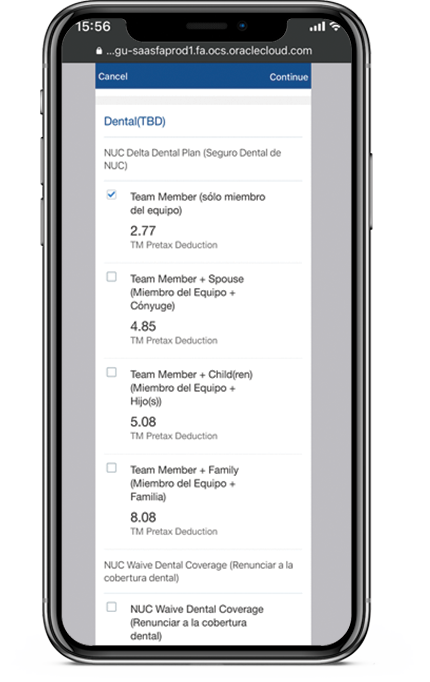

2025 Dental Weekly Rates

Coverage Level | Dental Weekly Rate |

|---|---|

| Team Member | $2.54 |

| Team Member Plus Spouse | $4.85 |

| Team Member Plus Child(ren) | $5.08 |

| Family (Team Member Plus Spouse Plus Child(ren)) | $7.85 |

| Single Plus Domestic Partner 1 | $4.85 |

| Single with Child(ren) Plus Domestic Partner 1 | $7.85 |

| Single Plus Domestic Partner with Child(ren) 1 | $7.85 |

Mortenson NUC Team Members, spouses, and dependents have access to an additional program at no cost when enrolled in the medical plan:

- 2nd.MD – Expert Medical Second Opinion vendor to provide guidance on an upcoming surgery or new diagnosis.

NO changes to medical co-pays (fixed amount for a covered service) when you visit the doctor:

- $0 – Virtual Visits and preventive visits

- $20 – Primary doctor office visits

- $40 – Specialist visits

- $50 – Urgent care visits

- $300 + deductible and coinsurance – Emergency room visits

- NO changes to pharmacy co-pays for prescription medications:

- $0 – Preventive

- $5 – Tier 1 medications

- $50 – Tier 2 medications

- $150 – Tier 3 medications

Important resources available at no-extra cost

Learn more about what Spring Health can offer here.

Taking care of your mental health is more important than ever. Team members, spouses and dependents (age 6+) have access to Spring Health, a mental health and wellness benefit, at no cost.

Spring Health offers access to free therapy (8 sessions per year) with available appointments within two days, personalized care, diverse providers, self-guided mental wellness exercises, work-life services, medication management, coaching, and more. Activate your benefit and get started by calling 1-855-629-0554, visiting mortenson.springhealth.com or emailing careteam@springhealth.com.

Whether it’s a stiff neck, aching shoulders or more severe back issues, it can be hard to enjoy life when pain shows up. That’s where Kaia steps in. It’s a new app here to show how pain relief is possible – at no extra cost as part of your health plan.

Access Kaia to receive:

- On-demand pain relief care in the convenience of an app

- Workouts tailored to you with some as short as 15 minutes

- Bite-sized lessons to help you recognize where pain is coming from

- 1-on-1 health coaching with certified professionals

- No extra cost – this is included as part of your health plan

- Strengthening exercises plus relaxation techniques for pain management

Visit startkaia.com/uhc or download the Kaia app today to get started.

You may have heard about or even used the Calm Health app. Beginning September 1, 2024, you have access to its most popular features and much more. Available through your health plan benefits at no additional cost to you, Calm Health includes:

- Check-ins — Complete a short screening so you can understand where you are in your journey and get a more personalized experience.

- Self-care courses and tools — Explore courses and tools focused on mindfulness, skills to help with anxiety, resilience, cultivating joy and better sleep.

- Six areas of support — Choose the tools that may help you achieve your well-being goals:

- Meditations — Follow along with guided practices

- Work — Avoid burnout and focus better at work

- Move — Move mindfully and stretch gently

- Music — Experience better focus, relaxation and sleep with music

- Sleep — Get more restful sleep and wake up feeling refreshed

- Soundscapes — Listen to calming sounds that help you relax, sleep, work or study

- Condition-specific content— Programs are designed to help deepen and strengthen the connection between body and mind, with expert mental health guidance and compassionate support for a wide range of mental and physical conditions.

- Life and life stages— Programs deliver guidance for some of life’s challenges and stages, including women’s health, support for parents of teenagers, and help with stressful situations like divorce or grieving.

- Coaching, counseling and therapy — Calm Health helps guide you to additional solutions and services from your health plan, such as coaching or therapy.

Visit myuhc.com and look for Calm Health to get started.

Beginning January 1, 2025, Maven®, a maternity and menopause support program, will be available through your health plan benefits at no additional cost to you, it includes:

- 24/7 access to virtual guidance, focused on your area of need

- Guided education as you learn about your upcoming pregnancy or parenting journey

- Access to specialized menopause professionals to best assist your personal situation

Your Next Steps

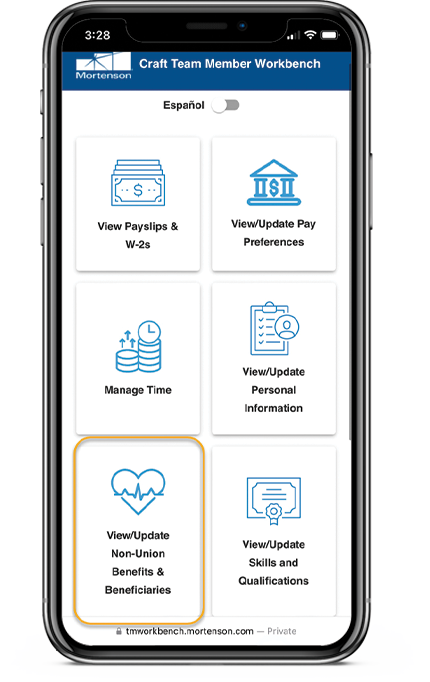

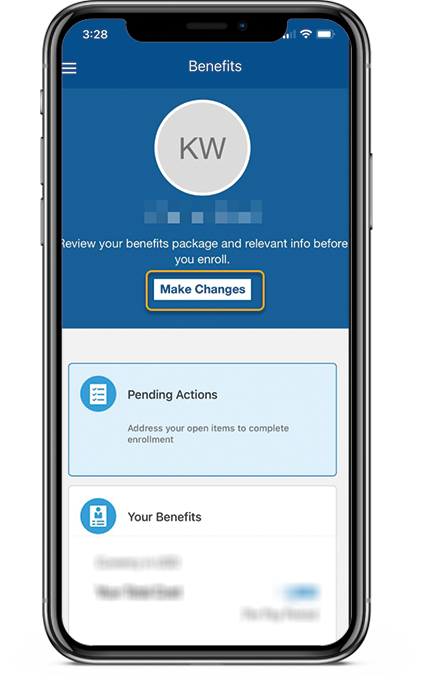

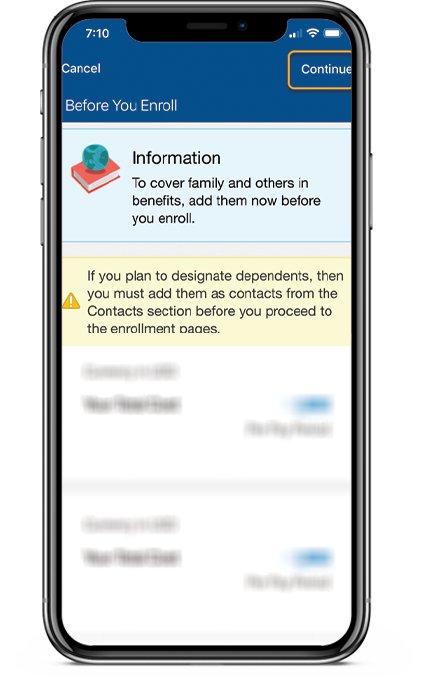

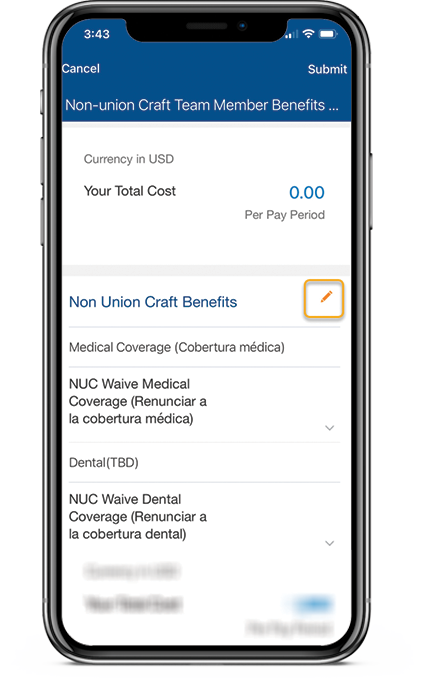

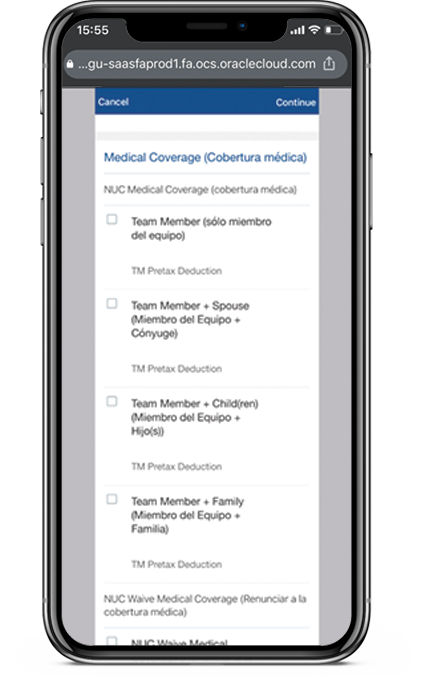

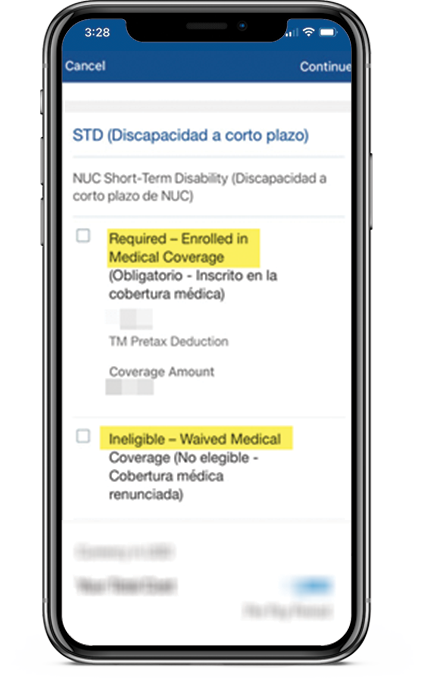

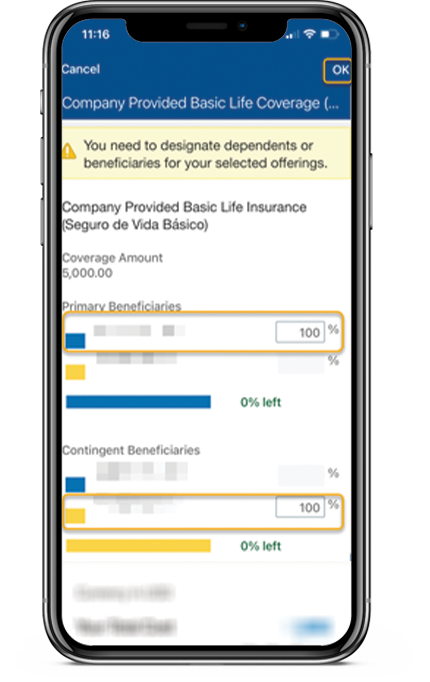

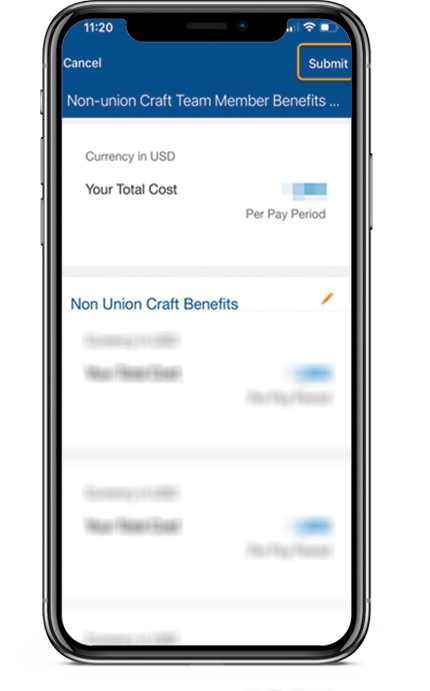

Login to your Team Member Workbench to update your 2025 benefits. Follow the step-by-step instructions below, or once logged in, select > View/Update Non-Union Benefits & Beneficiaries > Make Changes and begin the enrollment process.

Click through this step-by-step tutorial to learn how to enroll through Team Member Workbench this year.

NOTE: 2024 benefits will roll over to 2025 if no action is taken. All enrollments (medical plan, dental plan, life insurance beneficiaries) will continue from 2024 to 2025 even if you don’t log in to Team Member Workbench to make your elections.

Don’t wait until the last minute to enroll! Enroll in your 2025 benefits any time between October 14 and November 1. All changes you make to your benefits will be effective 1/1/2025.