Life Events

New hire

Welcome to Mortenson, we are excited to have you on our team! New non-union craft team members are eligible for medical, dental, vision, short-term disability, and additional life insurance benefits after 30 days and 401(k) benefits after 60 days.

Benefits overview

To enroll in benefits in your first 30 days:

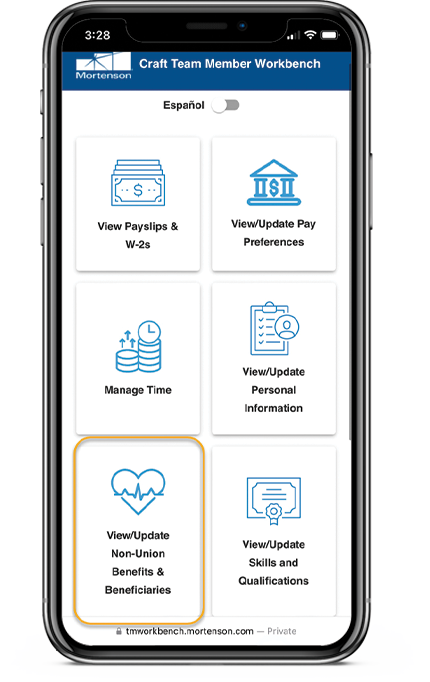

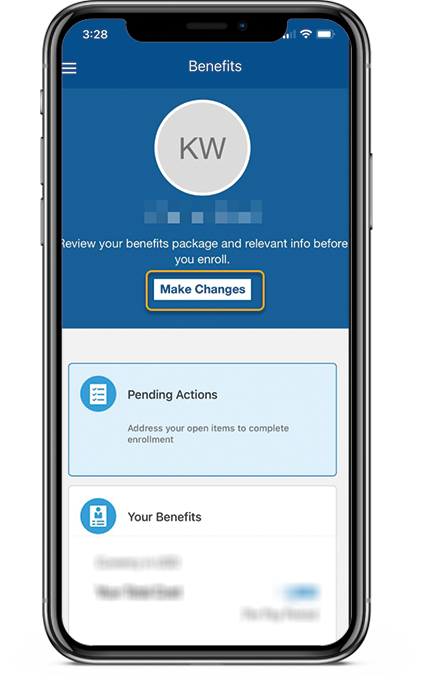

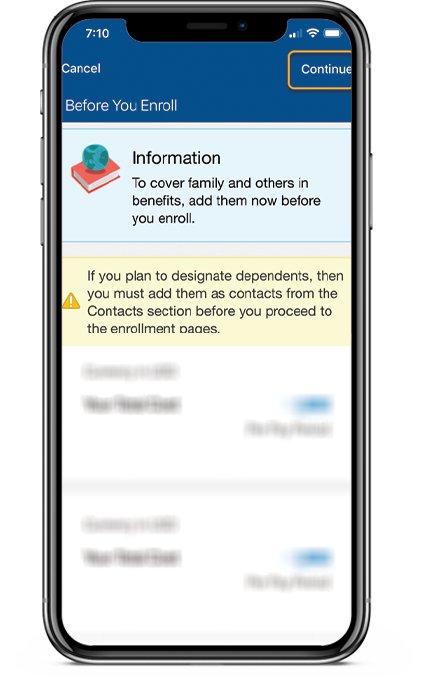

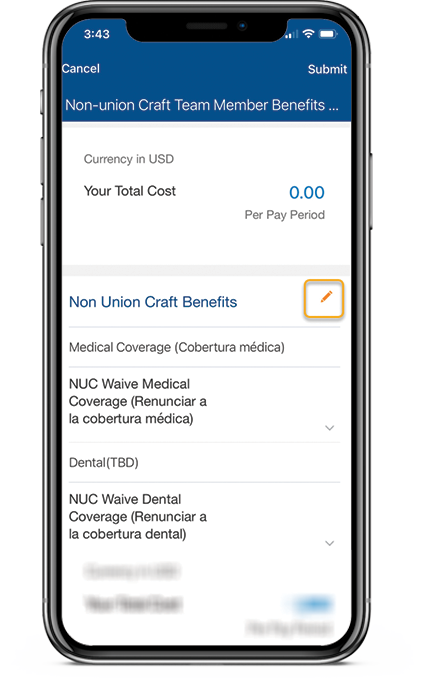

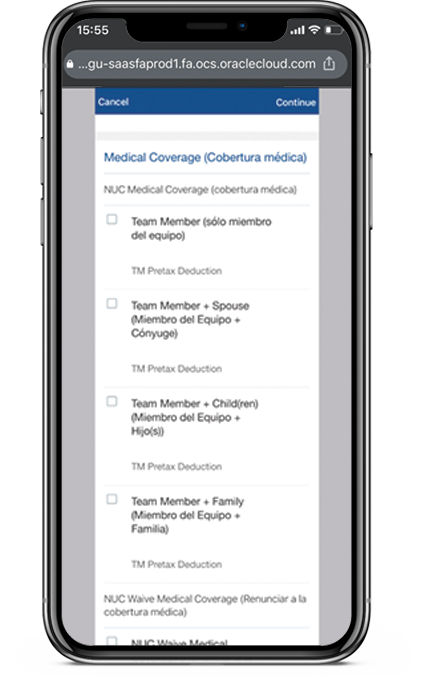

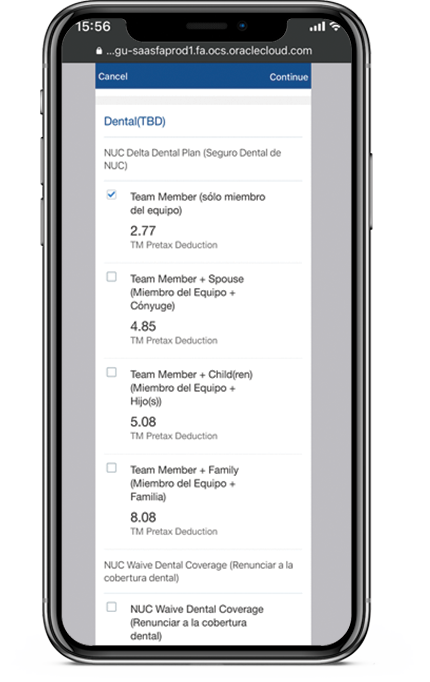

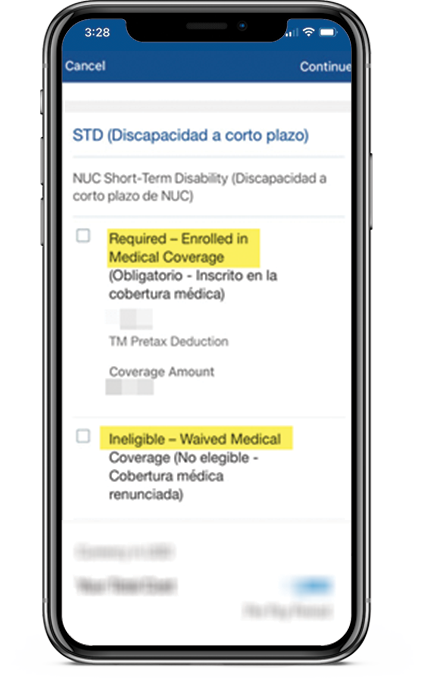

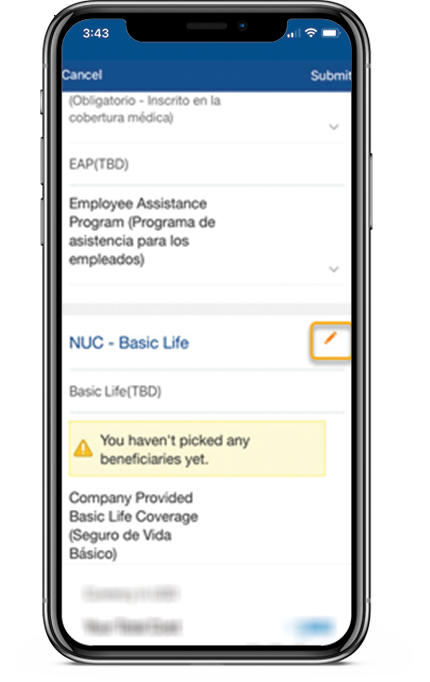

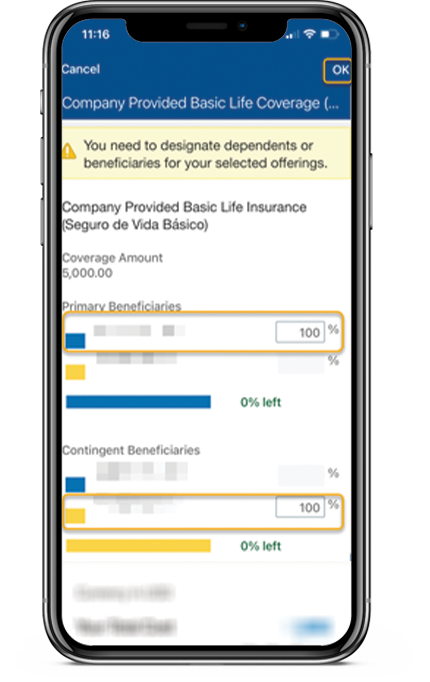

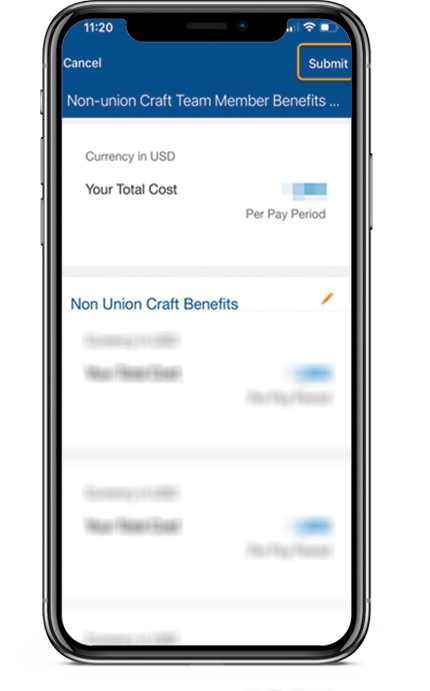

- Login to your Team Member Workbench to complete your 2025 benefits. Follow the step-by-step instructions here (Spanish here) or once logged in, select > View/Update Non-Union Benefits & Beneficiaries > Make Changes > and begin the enrollment process.

- Your benefits will be active the Monday following 30 days of employment and you will receive your insurance cards in the mail 2-3 weeks after your effective date.

Don’t wait until the last minute to enroll. Your benefits begin the first Monday following 30 days of employment. Benefits end on your date of termination/separation.

Click through this step-by-step tutorial to learn how to enroll through Team Member Workbench this year.

As a new team member, you have the following benefit options and choices:

- Medical Plan and who to cover: This election includes medical, pharmacy, vision and short-term disability.

- Dental Plan and who to cover

- Life Insurance: Mortenson will provide all team members with $50,000 in life insurance and access to optional life insurance and accidental death & dismemberment insurance (AD&D) for team members, spouses and children.

- 401(k): how much you would like deducted from your paycheck to save for retirement. You will be automatically enrolled for 4% after 90 days.

Mortenson Paid Benefits (no elections required)

Day 1 – You are eligible for:

- Paid Time Off

- Paid Holidays

- 2x your annualized base rate of pay (3x annualized base pay for Team Members with greater than 10 years of service)

- Spring Health

Team Member Optional Benefits (team member must elect coverage choices)

Day 30 – Choice to enroll in:*

- Medical

- Vision

- Short-term disability

- 2x your annualized base rate of pay (3x annualized base pay for Team Members with greater than 10 years of service)

- Dental

*Benefits don’t start until the Monday following 30 days of employment

401(k) Contributions

Day 60-90:

- 60 days: Eligible to start contributing to 401(k) after 60 days. Call Fidelity at 1-800-835-5095 or go to Fidelity NetBenefits website to set up your 401(k) contribution percentage or to opt out.

- 90 days: Automatically start 401(k) deductions after 90 days. You will be automatically enrolled in the 401(k) Plan with a 4% pre-tax contribution unless you have contacted Fidelity and made alternate elections or opted out of the Plan.

Service Awards

Service Anniversary Awards after 1 year, 5 years, 10 years, 15 years, 20 years, 25 years and every 5 years thereafter.

Reminder: Upon termination from Mortenson, your benefits end on the date of termination/last day worked. If you are rehired within 90 days, your benefits will be reinstated.

Employer Notices

If you are rehired within 90 days of your previous separation date and you had medical or dental benefits when you separated, you are eligible for medical and dental insurance to begin on your rehire date (you don’t have to complete the 30-day waiting period again).

Paid time off (PTO) accrual service restarts again, so you will begin accruing PTO based on your rehire date at 80 hours per year (accruing 1.54 hours per pay period). Any PTO balance you had for prior employment was paid out.

Union to Non-union transfer

Eligible for medical and dental benefits when your combined (union and non-union) service meets the 30 days waiting period.

Non-union to union transfer

All non-union craft benefits will end on the union transfer date.

Craft to Non-Craft

All of your Craft benefits will end and you will need to complete online enrollment to the Non-Craft benefits. Please email the HR Service Center. You have 30 days from your Non-Craft transfer date to enroll in Non-Craft benefits, Non-Craft benefits will be effective on your transfer date.

Transfer between projects

If you transfer between projects and have not separated employment from Mortenson, your current benefits are not impacted if both projects are Non-union.

If you enroll in a medical or dental plan the following eligible dependents may also be enrolled in coverage:

Spouse

Your spouse is the person with whom you are legally married. Individuals in registered domestic partnerships, civil unions and common law marriages are not considered spouses under the plan.

Your spouse is no longer an eligible dependent to be covered on Mortenson plans if you have divorced or legally separated.

Domestic Partner

A domestic partner is defined as:

- Shares your permanent residence for 1 year or longer

- Over 18 years old

- Financially interdependent with you

- Not a blood relative any closer than would prohibit legal marriage.

Domestic partners must be certified through Human Resources. For more information, please see the 2023 Domestic Partner Statement or 2023 Domestic Partner Statement (Spanish) [PDF] and reach out by emailing the HR Service Center as soon as you complete your benefit enrollment.

Child(ren)

Defined as:

- Any son, daughter, stepchild, eligible foster child, or adopted child of the team member who is less than 26 years old.

- The term child means a child born to you, or a child legally adopted by you.

- Also includes a step-child who lives with you, or a child for whom you are the legal guardian.

- Child(ren) 26 or more years old with a verified mental or physical disability are eligible to be covered if they are unmarried and primarily supported by a team member.

- Domestic Partner child, if covering Domestic Partner

Court ordered dependent coverage will automatically be changed when Mortenson receives court order documentation. Team members will be notified when Mortenson receives the court order.

Any dependent who does not meet a plan’s dependent eligibility requirements or is otherwise disqualified from eligibility is not considered an eligible dependent.

Transfer Craft to Non-Craft

Overview

Eligible for medical and dental benefits when your combined (union and non-union) service meets the 30 days waiting period.

All non-union craft benefits will end on the union transfer date.

All of your Craft benefits will end and you will need to complete online enrollment to the Non-Craft benefits. Please email the HR Service Center.

You have 30 days from your Non-Craft transfer date to enroll in Non-Craft benefits, Non-Craft benefits will be effective on your transfer date.

If you transfer between projects and have not separated employment from Mortenson, your current benefits are not impacted if both projects are Non-union.

Getting married

To help you think about how getting married may affect your benefits.

Benefit considerations

If you are changing your last name or moving to a new address you will need to update your personal information

Change your last name and address by emailing the Craft Payroll team or call 1-800-780-0642, option 2 (For Spanish, select option 1).

You will need your certified marriage license to update your personal information through your local Social Security Administration office and Department of Motor Vehicles.

Review your medical and dental plans to determine if you will add your spouse to your medical or dental coverage at Mortenson

Getting married is qualifying event so you can add medical or dental coverage for your spouse or cancel coverage and join your spouse’s plan. Complete the change in coverage form to make changes to your medical or dental coverage. Be sure to include any applicable documentation confirming your qualifying event. Review eligible dependents and required supporting documentation. You have 31 days from your marriage date to make these changes.

To review and re-evaluate your savings and investment strategy. Visit 401(k) or reach out a Fidelity advisor by calling 1-800-835-5095.

Life insurance

To review or change your life insurance beneficiary, email the HR Service Center or call 1-800-780-0642, option 3.

Fidelity 401(k)

Contact Fidelity 1-800-835-5095 or online at Fidelity NetBenefits website. After logging in, select the Menu button in the top right corner. Select the “Profile” button from the drop down. Click the link to “Beneficiaries”.

To change your marital status or number of exemptions for income tax purposes update your W-4 by emailing the Craft Payroll team or call 1-800-780-0642, option 2 (For Spanish, select option 1).

Even during a happy exciting life change such as marriage it can be stressful and there are various resources to support you through this journey.

FreFree mental health resources are offered through Spring Health, including eight (8) FREE therapy sessions per year at in network counselor or therapy office.

Expanding family (having baby or adopting)

To help you think about how expanding your family may affect your benefits.

Benefit considerations

Birth Mothers

If you are enrolled in medical you would be eligible for short-term disability coverage. Visit short-term disability for more information and call Cigna Leave Solutions at 1-888-842-4462 to file your disability claim.

All new birth mothers have 100% paid maternity leave following the birth of their child. In addition to short-term disability you are eligible to use paid-time off and if eligible, an unpaid Family Medical Leave Act (FMLA) leave.

Fathers, mothers, partners, and/or adoptive parents

Mortenson non-Union craft team members who have been employed by Mortenson for at least 6 months who become a parent either through birth, foster placement, or adoption are eligible for a 2 week (10 work days or 80 hours) paid leave to be taken following the arrival of your new child. You are also eligible to use Paid-time off and if eligible, an unpaid FMLA leave.

Parental leave must be taken in one day increments within 6 months of the birth, placement, or adoption of your child. Both mothers and fathers employed at Mortenson are eligible for parental leave.

It is important to discuss your planned parental leave timing well in advance with your manager (at least 30-days prior) so your team can plan accordingly. Parental Leave hours can be entered on your time card; select the Parental Leave pay type from the same place you select PTO or Holiday pay.

You will need to submit supporting documentation for your parental leave to HR Service Center (i.e. birth certificate, document from healthcare provider stating date of birth and child’s name, official adoption paperwork, or foster placement documentation).

Review your medical and dental plans to determine if you will add your child to your medical or dental coverage at Mortenson.

You can add your new child to the medical and dental plan. Complete the change in coverage form to make changes to your medical or dental coverage. Be sure to include any applicable documentation confirming your qualifying event.

Review eligible dependents and required supporting documentation. You have 90 days from from the date of birth, adoption, or placement to make these changes.

To review and re-evaluate your savings and investment strategy. Visit 401(k) or reach out a Fidelity advisor by calling 1-800-835-5095.

Life insurance

To review or change your life insurance beneficiary, email the HR Service Center or call 1-800-780-0642, option 3.

Fidelity 401(k)

Contact Fidelity 1-800-835-5095 or online at Fidelity NetBenefits website. After logging in, select the Menu button in the top right corner. Select the “Profile” button from the drop down. Click the link to “Beneficiaries”.

To change your marital status or number of exemptions for income tax purposes update your W-4 by emailing the Craft Payroll team or call 1-800-780-0642, option 2 (For Spanish, select option 1).

Even during a happy exciting life change such as an expanding family it can be stressful and there are various resources to support you through this journey.

Free mental health resources are offered through Spring Health including eight (8) FREE therapy sessions per year at in network counselor or therapy office.

$5,000 to reimburse you for the adoption of a new child to your family.

Mortenson is committed to providing a safe and healthy workplace and to promoting the health and well-being of its team members. As part of this goal, Mortenson recognizes the importance of breastfeeding. Learn more by reviewing our Lactation Accommodation Policy here.

Divorce or ending domestic partnership

To help you think about how getting divorced or ending a domestic partnership may affect your benefits.

Benefit considerations

Divorce or ending a domestic partnership can be stressful and there are various resources to support you through this journey.

Free mental health resources are offered through Spring Health including eight (8) FREE therapy sessions per year at in network counselor or therapy office.

If you are changing your last name or moving to a new address update your personal information, email the Craft Payroll team or call 1-800-780-0642, option 2 (For Spanish, select option 1).

You will need to clarify your intent to change your name complete the Change of Coverage Form [PDF] with all necessary documentation and follow the steps associated with restoring your previous name.

How is you medical and dental coverage impacted?

- Does your spouse or domestic partner need to be removed from Mortenson coverage?

- Did you lose coverage and need coverage through Mortenson?

- Do your children have coverage?

Complete the change in coverage form to make changes to your medical or dental coverage. Review eligible dependents and required supporting documentation. You have 31 days from your divorce/separation to make these changes.

Qualified Domestic Relations Order (QDRO)

Fidelity offers a QDRO Center allowing you to quickly and effectively prepare your Qualified Domestic Relations Order, visit the Fidelity’s QDRO Center website page for more information.

Qualified Medical Child Support Order (QMCSO)

To find more information regarding a Qualified Medical Child Support Order (QMCSO) visit the U.S. Department of Labor website and review the Qualified Medical Child Support Orders [PDF] to work through the process.

To review and re-evaluate your savings and investment strategy. Visit 401(k) or reach out a Fidelity advisor by calling 1-800-835-5095.

Life insurance

To review or change your life insurance beneficiary, email the HR Service Center or call 1-800-780-0642, option 3.

Fidelity 401(k)

Contact Fidelity 1-800-835-5095 or online at Fidelity NetBenefits website. After logging in, select the Menu button in the top right corner. Select the “Profile” button from the drop down. Click the link to “Beneficiaries”.

To change your marital status or number of exemptions for income tax purposes update your W-4 by emailing the Craft Payroll team or call 1-800-780-0642, option 2 (For Spanish, select option 1).

Retiring or leaving the company

Several factors come into play when your employment with Mortenson ends.

Printable Offboarding Information here.

Benefit impact

Your final paycheck and PTO payout will be issued on the regularly scheduled pay date unless state guidelines require an earlier date.

Payment will be made in the same manner as all other previous paychecks – e.g. direct deposit or check. Your final paystubs will be printed and mailed to your home address.

For more information, email the Payroll team or call 1-800-780-0642, option 2 (For Spanish, select option 1).

Coverage ends on your last day worked. You may continue coverage under COBRA.

WEX, our COBRA vendor, will mail you COBRA paperwork approximately 2 weeks after your last day worked. COBRA is effective the first day after loss of coverage and is retroactive once election and payment is made to WEX.

WEX (COBRA)

Call: 1-866-451-3399

WEX Benefits website

UnitedHealthcare (Medical)

Call: 1-833-209-6462

myuhc.com® website

VSP® (Vision)

Call: 1-800-877-7195

VSP website

Delta Dental of Minnesota (Dental)

Call: 1-800-448-3815

Delta Dental of Minnesota website

Contact our vendor, Fidelity, to discuss rollover and/or withdrawal options available to you.

Fidelity

Call: 1-800-835-5095

Fidelity NetBenefits website

Please return all Mortenson assets to your manager/supervisor prior to your separation.

Income and employment verifications are done through Equifax – The Work Number, in a secure streamlined manner 24 hours a day/7 days a week. Please refer to Guide to The Work Number [PDF] for details on this service.

If you have additional questions, please email the Payroll team or call 1-800-780-0642, option 2 (For Spanish, select option 1).

W2 forms will be mailed to your address on file in compliance with Federal regulations. If you do not receive a W2 form, please email the Payroll team or call 1-800-780-0642, option 2 (For Spanish, select option 1).

To update your address in Mortenson’s record, please email your current mailing address to the Payroll team.

Diagnosed with a medical condition or serious illness

Mortenson has various benefits to support you and your family with health concerns.

Benefit considerations

Medical and pharmacy needs, any upcoming procedures, hospital stays, planning for transition to home health care.

Reach out to the CareConnect team for assistance and to be connected with a team with nurses, doctors and pharmacists to help you navigate and manage your condition.

Being diagnosed with a medical condition or serious illness can be stressful and there are various resources to support you through this journey.

Free mental health resources are offered through Spring Health, including eight (8) FREE therapy sessions per year at in network counselor or therapy office.

Will your situation require prolonged absence from work?

If you are enrolled in medical you could be eligible for short-term disability coverage. Visit short-term disability for more information and call Cigna Leave Solutions at 1-888-842-4462 to file your disability claim.

In addition to short-term disability, you are eligible to use paid-time off and if eligible, an unpaid Family Medical Leave Act (FMLA) leave.

To review and re-evaluate your savings, adjust your investment strategy or update your beneficiaries login to your Fidelity account or reach out a Fidelity advisor by calling 1-800-835-5095. You can also find more information in the 401k section of this site.

Other changes

Relocated or moved, Medicare eligible, empty nest, loss or gain of coverage

To update your address in Mortenson’s record, please email your current mailing address to Craft Payroll team.

Mortenson medical coverage would be considered primary if you maintain coverage on Mortenson’s plan while on Medicare. You are not required to purchase Medicare Part B or Part D coverage while on Mortenson medical and pharmacy plan.

Becoming eligible for Medicare would be considered a qualifying event and would allow you to cancel Mortenson’s coverage if desired.

Having your children leave for college or move into their own residence

- Your children could stay on Mortenson medical and dental coverage until they are 26 years old.

- Coverage will end the last day of the month a dependent turns 26 and this will trigger a COBRA notice to continue coverage if desired.

- If coverage ends for your youngest child on the plan your coverage will automatically change to team member only or team member and spouse/domestic partner.

Review dependent eligibility.

Review your W4, to change your number of exemptions for income tax purposes update your W-4 by emailing the Craft Payroll team or call 1-800-780-0642, option 2 (For Spanish, select option 1).

If you or your dependents lose or gain coverage, this would be considered a qualifying event and you could add or cancel Mortenson’s coverage if reported within 30 days.